Home Depot: The Unsung Powerhouse Behind America’s Homes

Why a 2025 Stock Dip Masks a Strong Long-Term Growth Story in the Home Improvement Giant

In a world obsessed with flashy tech stocks and AI breakthroughs, Home Depot ($HD) is often overlooked. Yet this retail giant quietly shapes the fabric of American homes, driving a massive portion of the $500+ billion home improvement market.

So when Home Depot’s stock dropped roughly 15% in 2025, many were left scratching their heads. How can a company so fundamental to housing and renovation falter? And more importantly, what does it mean for investors?

Let’s unpack the story behind the numbers, the market forces, and the opportunities.

What Makes Home Depot So Important?

Home Depot isn’t just a store — it’s the backbone of home renovation for millions of Americans. From weekend DIYers to professional contractors building large projects, Home Depot serves them all.

With over 2,600 stores across the U.S., Canada, and Mexico, Home Depot offers an unparalleled selection of everything you could need to build a home.

But it’s more than just shelves and products. Home Depot has built an ecosystem, with expert in-store advice, installation services, and a rapidly growing digital platform offering buy-online-pickup-in-store and same-day delivery.

Home Depot by the Numbers (FY 2025)

Revenue: Approximately $160 billion

Net Income: Roughly $17 billion

Employees: Around 500,000

Market Cap: Near $300 billion as of July 2025

Dividend Yield: About 2.5%, with a strong track record of yearly increases

Stores: Roughly 2,600 locations

What’s Behind the Recent Stock Weakness?

Despite this impressive scale and financial strength, Home Depot’s shares slid about 15% from their 2024 highs. Here’s why:

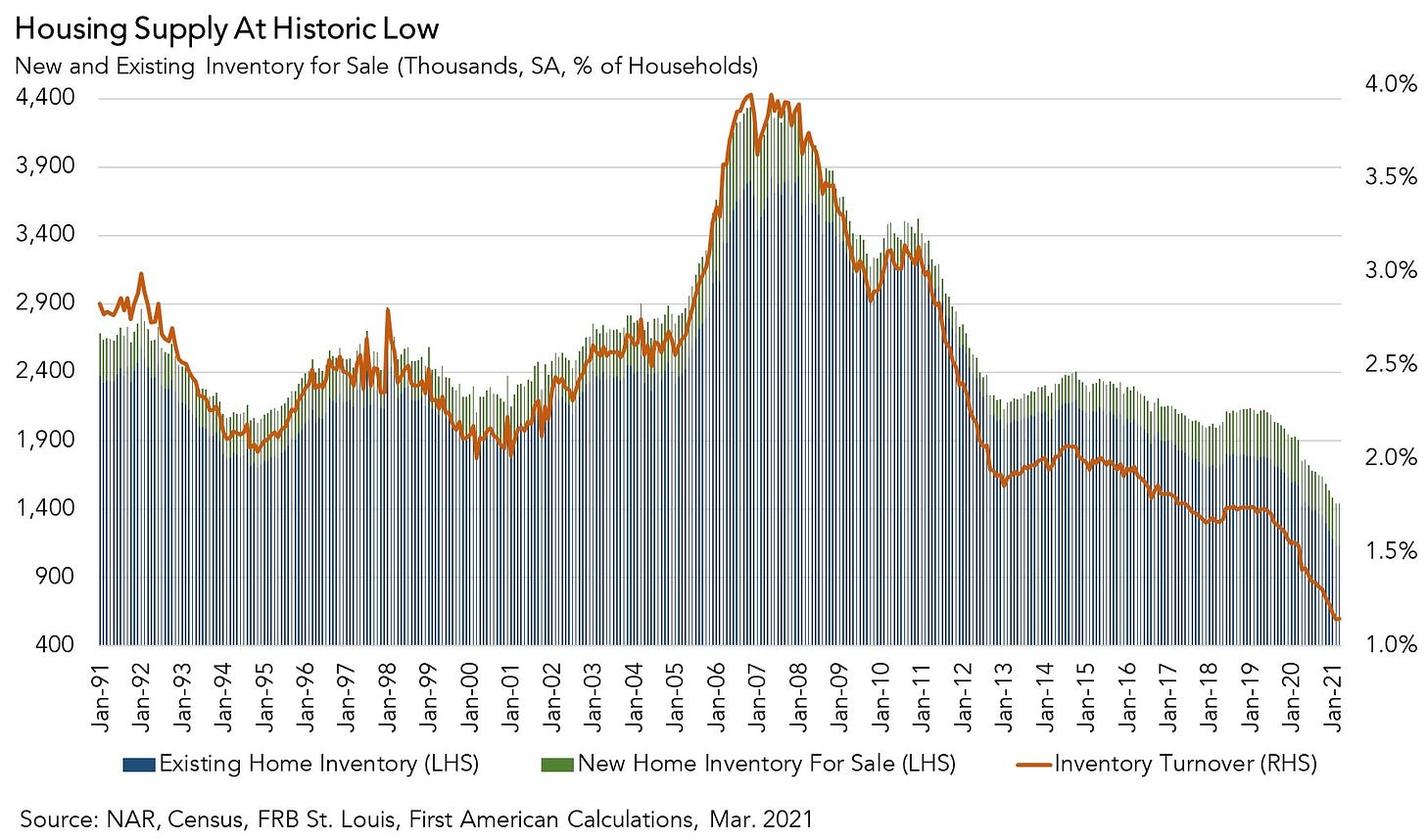

1. The Housing Market Has Cooled

Home Depot’s business is closely tied to the health of the housing market. When home sales soar, renovations and remodeling follow. But by mid-2024 and into 2025, rising mortgage rates—now hovering near 8%—have slowed home buying and refinancing activity.

This slowdown means fewer people are jumping into big projects, whether that’s remodeling a kitchen, building a deck, or upgrading plumbing.

As a result, fewer trips to Home Depot.

Translation: Less Homes being constructed = Less revenue for home depot

2. Inflation and Shifting Consumer Behavior

Rising inflation throughout 2023 and 2024 increased costs across the board—from raw materials like lumber and steel to transportation and labor.

While Home Depot has pricing power and has passed many cost increases to customers, higher prices combined with economic uncertainty have made some consumers postpone or downsize projects.

For example, a homeowner planning a $10,000 renovation might now cut it back to $7,000 or delay entirely.

Translation: people are waiting to renovate their homes

3. Supply Chain Challenges and Margin Pressures

Though improved from the pandemic era, supply chains still face disruptions.

Higher freight costs and labor shortages have increased expenses. Home Depot’s margins, which traditionally hover around 33–35%, have faced some compression as a result.

The company invests heavily in inventory management and logistics to smooth this, but it’s a balancing act that weighs on short-term profits.

4. Market Sentiment & Sector Rotation

Wall Street’s appetite in 2025 has shifted toward high-growth technology, AI, and energy stocks, which promise faster returns.

Retail and consumer staples stocks like Home Depot are viewed as “slow and steady” plays, solid but less exciting in the short term.

This rotation has meant capital flows out of retail stocks, adding to HD’s price pressure.

Why Home Depot’s Long-Term Outlook Remains Strong

Despite these headwinds, Home Depot holds a uniquely strong position in the market:

A Market Leader with a Durable Moat

Home Depot commands roughly 25% of the U.S. home improvement retail market, well ahead of competitors like Lowe’s and Menards.

Its scale gives it immense purchasing power, allowing aggressive price negotiation with suppliers and better inventory availability for customers.

Expanding the Pro Customer Base

About 45% of Home Depot’s sales come from professional contractors and tradespeople — plumbers, electricians, builders, and remodelers who make regular, large purchases.

Unlike casual DIY customers, pros are less price-sensitive and offer steady, repeat business.

Home Depot is doubling down on this segment by offering specialized services, volume discounts, and technology tools to streamline their buying experience — locking in loyalty and boosting long-term revenue stability.

Digital Transformation Is Paying Off

Home Depot’s investments in e-commerce have been game-changing. The rise of buy-online-pickup-in-store (BOPIS), same-day delivery, and mobile app shopping have made it easier than ever to shop.

During 2025, digital sales continue to represent about 15–20% of total sales, and this is expected to grow, blending the best of online convenience with local store inventory.

Shareholder-Friendly Capital Return

Home Depot has consistently returned cash to shareholders via dividends and share buybacks.

Its dividend yield (~2.5%) and a strong history of annual increases make it attractive for income-focused investors.

Additionally, steady buybacks help support the stock price and signal management confidence in the business.

What Investors Should Watch Next

Housing Market Trends

Mortgage rates, housing starts, and remodeling trends will heavily influence Home Depot’s near-term growth. Any signs of stabilization or recovery could boost sales.

Inflation and Margin Management

Can Home Depot control costs and maintain healthy profit margins despite inflation and supply chain pressures?

Growth in Professional Segment and Digital Sales

The company’s success in expanding its pro customer base and digital capabilities will be key drivers of sustained revenue growth.

Broader Market Sentiment

Retail stocks often lag during tech and AI booms. Watching how investor appetite shifts over time can present buying opportunities.

The Bottom Line

Home Depot is not a company chasing headlines or flash-in-the-pan trends. It’s a steadfast leader in an essential industry, powering America’s homes and infrastructure.

While 2025 has been a year of challenges, from housing slowdowns to inflation and market rotations, the company’s moat, scale, and strategic investments point to a bright long-term future.

If you’re an investor willing to look beyond short-term volatility and trust in Home Depot’s resilience, this could be a stock worth holding through the cycle.

In the grand scheme, Home Depot is less about hype and more about hard work—building, fixing, and improving homes, neighborhoods, and portfolios.

—Krushna